- Financing should be paid into the less than six ages.

- No installment punishment.

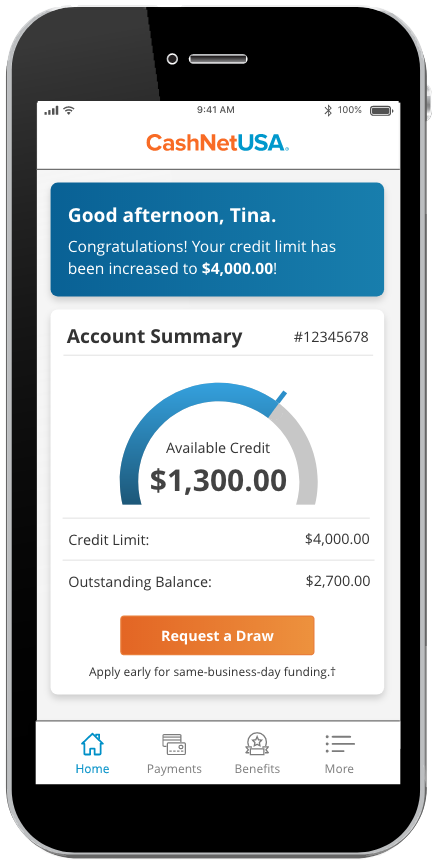

- Sturdy mobile software enables with the-the-wade handling of the loan.

- Borrowing from the bank Wellness Tool will assist in keeping your financial life towards tune.

- Origination commission out-of ranging from 2.8% and 8%.

- Late commission costs off $ten.

- No reduced prices for autopay.

A house security financing, that is closely pertaining to domestic security line of credit (HELOC), is financing applied for from the guarantee you really have in the your residence.

Brand new guarantee ‘s the difference in that which you possess paid back and you may what you still are obligated to pay. For-instance, if the residence is appraised at $three hundred,000 therefore owe $100,000, your guarantee are $two hundred,000. One to number is what a loan provider use to include your which have a certain buck amount during the that loan otherwise collection of credit. Your home guarantee mortgage are secure by the household.

A house improvement loan is a personal bank loan. It will not tap into this new security of your house otherwise play with your home once the security should you decide can’t shell out the mortgage back. It means the financial institution takes on a high exposure inside the bringing the loan to you personally, and as a result, you might select large interest rates much less advantageous terms and conditions.

Although not, its an important solution if you’re looking to own a tiny amount of money, particularly doing $10,000 to fix one leaky rooftop, or you want to get your hands on the money having a primary fix, like fixing the new sewer system.

Simple tips to Compare to Get the best Mortgage

The new Annual percentage rate, otherwise Apr, is the interest rate could shell out across the lifetime of the borrowed funds. Usually, the greater your credit score and you will credit rating, the reduced the Apr was.

There is a bottom Annual percentage rate, such as for example 4.99%, that’s set aside just for a knowledgeable borrowing from the bank-proprietors otherwise people that commit to that loan to own a certain amount that needs to be reduced inside a shorter time.

Origination fees

Certain loan providers require a keen origination commission. Which commission try used just at the start of the mortgage, or even in some instances, you could prefer to spend it by themselves, up-side.

That it payment can be put on help the financial recoup its will cost you within the papers, day, or any other expenses they incur during the providing you with the loan.

Discover a loan provider that will not need an enthusiastic origination commission, because these can find thousands of dollars, depending upon the size of your mortgage.

Bells and whistles

Most other bells and whistles include a strong mobile app for addressing your loan at any place, the possibility to help you re-finance, the chance to change your fee repayment dates, or perhaps the ability to pull in a great co-signer having increased loan amount, if required.

Repayment months and you may terms

The majority of it may rely upon how much the borrowed funds was for; it is unrealistic financing out-of $5,000 can come that loans in Guilford Center have a great 10-season cost bundle.

Look at the repayments called for monthly to influence what payment months you could potentially comfortably deal with. In addition to, look at the fine print: will there be a penalty to possess paying the borrowed funds early?

Investment Time

If you are thought ahead, this may never be a problem. For-instance, whenever you are taking out that loan for the bathroom renovation that’s booked for most months off now, then how in the near future you should buy the cash may not amount as frequently.

But when you have a leaking roof and it’s really the newest level out-of springtime violent storm seasons, you might need that money as quickly as possible. Some businesses give a funding lifetime of not all the days away from recognition of one’s loan, while some usually takes a couple weeks.

par WolfNight

par WolfNight

Laisser un commentaire