To purchase a home making use of the Virtual assistant mortgage system is perhaps the number one advantageous asset of army membership, as well as the VA’s assessment procedure is likely the most important part of the property pick processes.

One of the most concrete and worthwhile gurus open to those individuals just who choose suffice its country courtesy military services ‘s the Va financial system. Even though all homebuying techniques try a search away from browsing for house into the closure table, the brand new Virtual assistant has many requirements novel in order to its system that are designed to manage the debtor and make certain an audio financing.

It coverage exists in the way of brand new Va financing appraisal, something in which an approved appraiser establishes the business well worth and assesses the state of a property. That it investigations varies than simply a traditional house evaluation, as well as the VA’s requirements often differ some about assessment conditions you to a debtor carry out see through other mortgage applications.

What exactly is an excellent Va Loan Assessment?

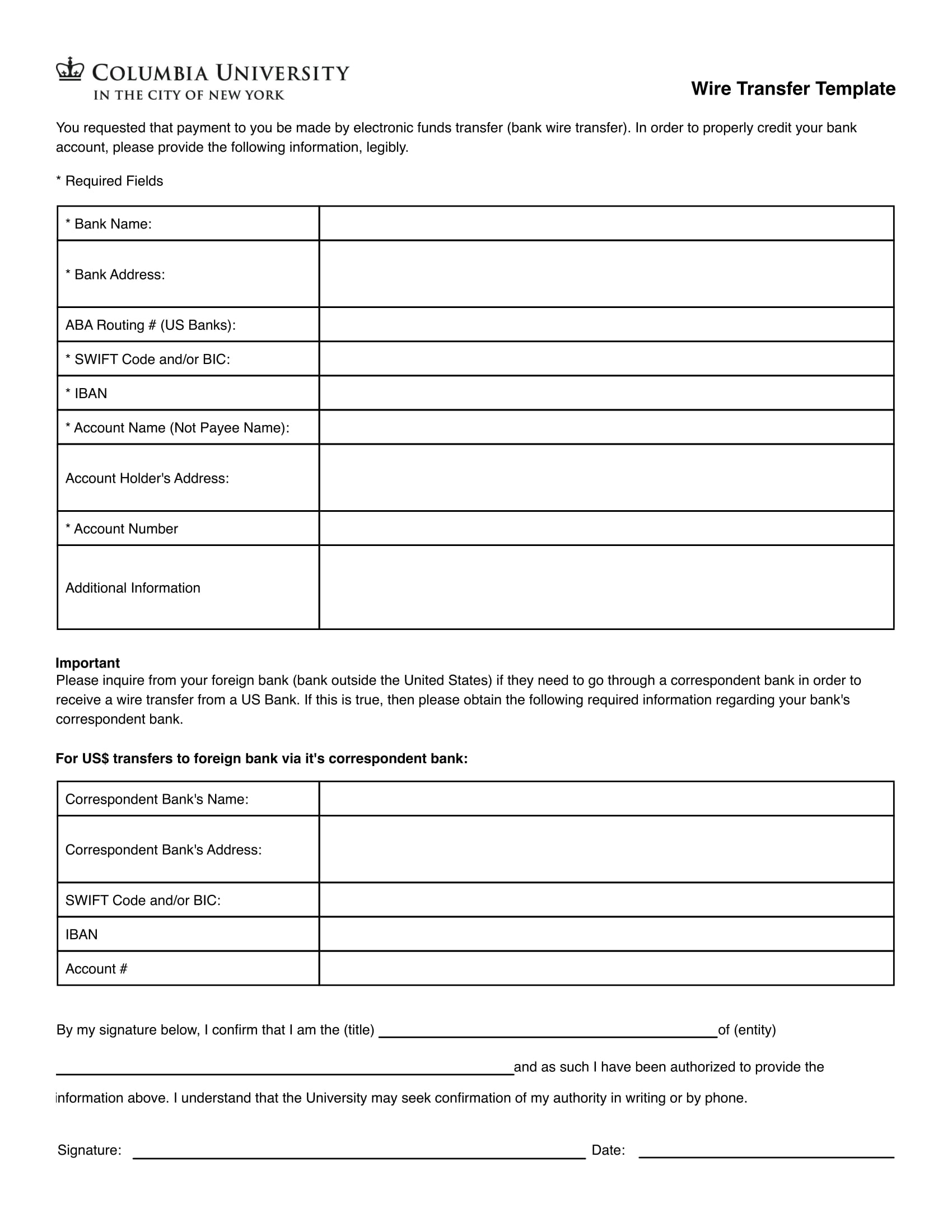

A beneficial Va financing assessment was an offer out-of good property’s markets well worth in fact it is conducted because of the a great Va-approved appraiser, making sure the house or property qualifies into asked amount borrowed. A house must also see a list of standards set from the this new Virtual assistant, titled Lowest Property Conditions (MPRs). This assessment techniques is required from the Agencies out of Veterans Things for everybody Virtual assistant home loans and money-aside refinances.

A Va loan assessment will even make sure the residence is an audio funding and as well as livable when a buyer takes possession.

A debtor is mislead between your Virtual assistant appraisal process and the fresh new protections given by a classic house review. Because there is positively specific overlap as to what a beneficial Va appraiser will look to own regarding the work to be certain livability and you will reasonable market price, a property inspector takes a level better diving on the all facets of the home as well as assistance to obtain and you will banner possible issues before the buy is actually closed.

A separate product to note is the fact whenever you are a Virtual assistant assessment is needed to safer an excellent Virtual assistant home loan, a home evaluation is elective underneath the system. Ergo, it is essential to learn what’s included in for each and every testing and you can where you’re vulnerable should you forgo our home evaluation.

Once again, the fresh new Virtual assistant appraisal often assess the property to own a choose number of requirements to make certain it is safer, sanitary, livable and you can an audio funding into the client. However, passage and you may compliant these types of minimum property guidelines as place by Virtual assistant only discusses particular categories, meaning a purchaser might still become at risk of a variety of other problems.

But also for an incredibly more compact costs, a property inspector takes an in-breadth see every aspect of the house, looking and you will assessment getting present and you will potential trouble throughout the most important options and areas like the structure, cables, plumbing work, Heating and cooling, roof, drainage, and much more.

How come new Va Need an assessment?

This new assessment processes is necessary for Va mortgage brokers since it guarantees the latest homebuyer is actually and work out a sound investment inside the a house it is not expensive cash loans Edwardsville or perhaps in demand for significant fixes. The method including assures the brand new Service from Pros Circumstances are backing a loan that will not surpass the property’s market price. Put another way, the latest appraisal is meant to protect and you will shield new interests out-of both borrower and also the mortgage guarantor (this new Va).

Minimum Assets Requirements (MPRs) Getting Virtual assistant Appraisals

Very, what will a Virtual assistant-acknowledged appraiser discover whenever determining a house? This new Virtual assistant has created a summary of Minimal Property Requirements (understand the record here) you to definitely appraisers need certainly to opinion to ensure property is safe, structurally sound and you will sanitary, certainly one of most other considerations. The new MPRs cover each one of the pursuing the regions of a beneficial property’s indoor and you may external:

par WolfNight

par WolfNight

Laisser un commentaire